Groma UPREIT

A tax-advantaged way to sell your property

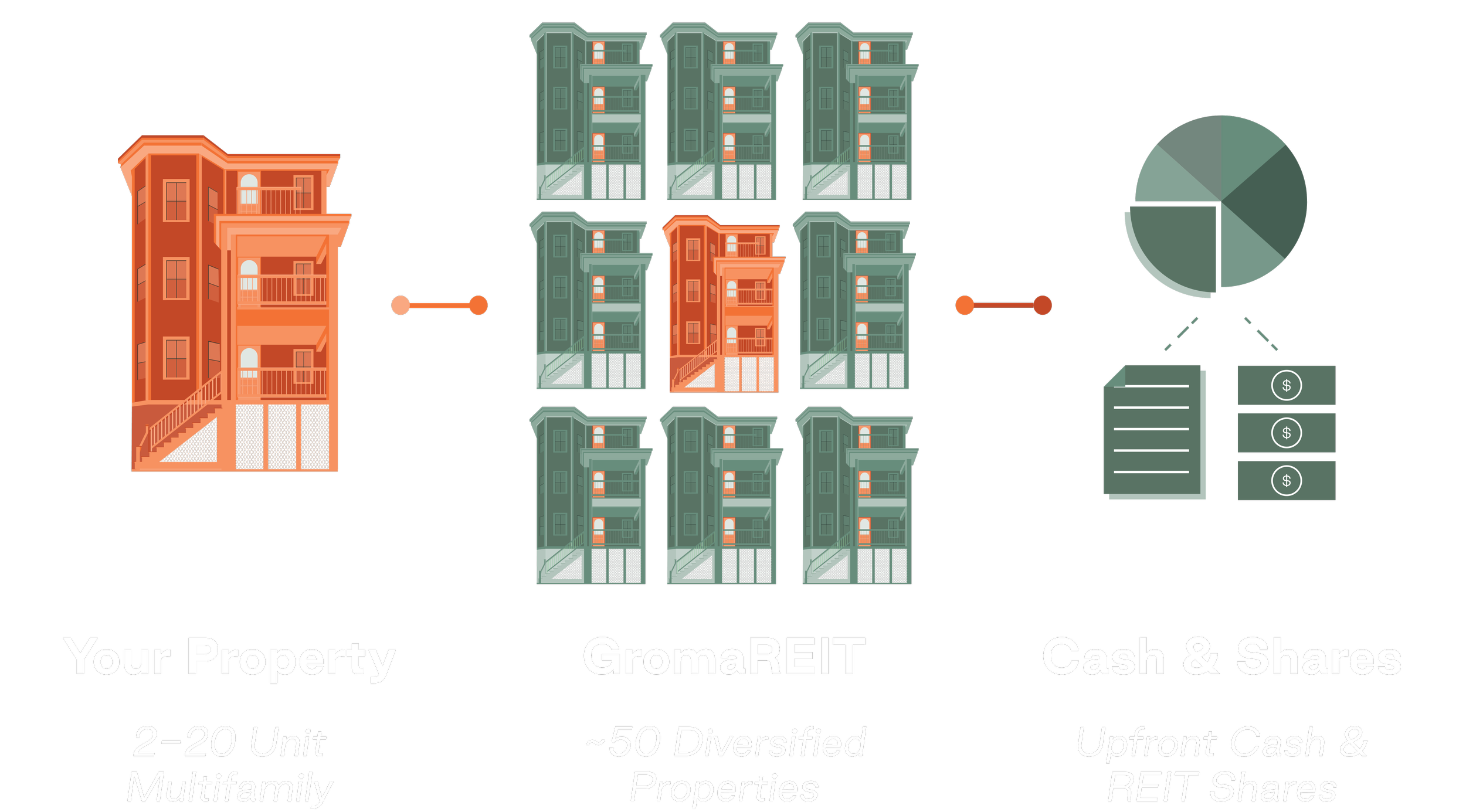

Sell your asset for a combination of cash and tax-deferred shares in Groma’s multifamily ~50 building portfolio.

Groma is a Boston-based real estate firm. We focus on small-unit-count multifamily assets (2-20 units) and leverage our technology to increase efficiency of operations while improving resident experience. Our flagship vehicle, the GromaREIT, owns ~50 “triple-deckers” in the Greater Boston area.

About Groma

What's an UPREIT transaction?

REIT stands for Real Estate Investment Trust. REITs are a specialized type of real estate investment vehicle that can provide tax advantages to their investors.

An UPREIT transaction allows investment property owners to sell their property in exchange for a combination of cash and shares in the REIT’s diversified portfolio of properties. While the cash proceeds are taxable, like a normal sale, the ownership units can benefit from tax deferral.

An UPREIT transaction is similar in many ways to a 1031 exchange, except instead of exchanging one building for another, a building is exchanged for a combination of cash and REIT shares.

Benefits of an UPREIT

-

Deferral of Capital Gains

Rather than paying a ~30% capital gains tax on sale, the portion of your proceeds taken in REIT shares is tax-deferred, meaning more of your asset value stays active, earning dividends and experiencing appreciation.

-

Upfront Cash Proceeds

UPREIT transactions combine upfront cash with tax-deferred REIT shares. While the cash portion is taxable, a blend of upfront liquidity and ongoing diversified interest in the REIT is compelling to many sellers.

-

Professional Management

Groma is a full stack real estate operator. Once you complete an UPREIT transaction, all property management responsibilities (and liabilities) sit with Groma, giving you time back and peace of mind.

-

Minimize "Millionaire's Tax"

Your sale may expose you to the new 4% surcharge during the year of your sale. The portion taken in REIT shares is tax-deferred, with gains only taxed at sale, enabling you to manage your tax exposure over time.

-

Diversification + Scale

Groma’s scaled operation improves the financial performance of the underlying properties and enables efficient compliance with the ever-increasing regulatory landscape of managing rental properties.

-

Growth + Income

Enjoy the potential for long-term appreciation alongside quarterly dividends in a passive, diversified investment as a shareholder in the GromaREIT.

Example UPREIT

Transaction

The above simplified model assumes a $100,000 depreciated cost basis and a tax rate of 30%. While every transaction will be different, this model is meant to showcase the broad strokes of how an UPREIT transaction functions.

With these assumptions, the results across a traditional sale, a Full UPREIT and a 50/50 UPREIT & Cash Sale are striking:

FAQs

-

When you sell your property, up to 30% of the gain in value will likely be owed to the state and federal government in taxes. An UPREIT with Groma provides a tax advantaged way to sell your property and keep more of the proceeds.

Groma purchases and operates 2-20 unit urban multifamily rental properties for a mix of up to 50% cash and 50% REIT shares. REIT shares ownership interests in the diversified GromaREIT portfolio of ~50 properties.

Cash proceeds are taxable, like a normal transaction. But REIT shares are tax-deferred, presenting significant tax savings such as lessening exposure to the 4% Millionaire’s Tax surcharge. REIT shares are taxed when sold, but you control when you sell them, spreading your tax exposure over time. By leveraging other techniques, such as depreciation offsets or estate planning strategies, you could further minimize tax expenses.

Equally important, the portion of the sale taken in REIT shares stays active and working for you, potentially growing in value and earning quarterly dividends, all without you having to actively manage the real estate. (That’s our job!)

UPREITs have been a popular form of real estate transaction for very large (>$50m) sales for many decades. Groma is bringing those same structuring benefits to small multifamily property owners, opening up a new and potentially advantageous avenue to sell your property when you’re ready to do so.

While an UPREIT transaction isn’t for everyone, we believe it is a compelling option for many owners, and would be happy to tell you more about it over a Zoom meeting, or in-person at our downtown Boston offices.

-

An UPREIT is similar in many ways to a traditional real estate sale. Here is a high-level overview of the process:

Fill out the form below to schedule a time to talk with a Groma team member. We are happy to connect over phone, Zoom, or to invite you for a meeting at our offices at 31 New Chardon Street, Boston MA 02114.

We will then evaluate your property. This includes asking you some questions and then later performing an on-site inspection, which we are happy to do in a fashion that is not disruptive to your existing tenants.

We will provide you with a confidential, non-binding estimate of what the GromaREIT would pay for your building in an UPREIT transaction.

You can review our UPREIT transaction proposal and accept or reject it.

If you choose to accept it, we will proceed to transaction documents using our standard forms, which should be thoroughly reviewed by your accountants, legal advisors, and anyone else you deem appropriate.

On transaction day, you will receive:

Cash

Your upfront cash payment or first quarterly guaranteed payment

On an ongoing basis, you will receive:

Quarterly GromaREIT dividends quarterly

Quarterly report on the current asset value of your shares

Other reports and ongoing updates from the GromaREIT

-

Traditional property ownership generates direct income:

+ rent

- expenses

- debt service

= net income.

If you had a $1M property with three units rented at $2.5K per unit per month, your property might generate $90K in gross annual rental income. After expenses and debt service, that might generate $30-45K in pre-tax net income for you.

In an UPREIT transaction, you sell your $1M building for cash and an equivalent value of ownership units in the GromaREIT. Depending on how much of that transaction you take in GromaREIT shares, and the current dividend rate of the GromaREIT, you may end up earning less, or more, income per year than your direct ownership of your property.

However, by unlocking 50% of the proceeds in upfront cash, and leaving the rest in GromaREIT shares producing dividends, we believe an UPREIT transaction with Groma can provide a compelling blend of cash and real estate exposure.

We also offer the ability to spread out up to 50% of the proceeds in cash over a three-year period as guaranteed quarterly payment. This may be preferable for tax structuring reasons, e.g. to avoid higher tax rates and surcharges like the 4% Millionaire’s Tax.

-

Must be a residential apartment building; a commercial unit or two on the first floor is OK.

Must be between 2 and 20 units

We do not acquire single family rentals, properties with >20 units, commercial, lab, industrial or other asset types.

Must be in the Greater Boston area. We may expand to other regions in the future, but at this time, only Greater Boston.

Must not have in-place debt ratio of greater than 60% LTV (debt outstanding compared to potential sale price).

Properties can require significant renovations or upgrades–Groma often renovates new acquisitions.

Properties can be fully tenanted or partially or fully vacant.

We will consider properties with challenging in-place tenants. We recognize the stress those situations can cause and Groma has a strong compliance-oriented legal team that may be able to more effectively and amicably resolve those situations, taking a burden off your plate.

The property owner must be an accredited investor to participate.

Other requirements may apply.

-

The Groma team is always happy to answer any questions you may have regarding the UPREIT process or Groma, please email upreit@groma.com.

To learn more about Groma, visit www.groma.com

To view Groma’s current portfolio of multifamily buildings in the Greater Boston area, visit www.groma.com/properties

-

Fill out the form below and one of our team members will reach out to provide more information on the Groma UPREIT process.

-

To learn more about the Groma UPREIT offering, please read the GromaREIT Private Placement Memorandum at upreit.groma.com/ppm

-

The Groma UPREIT option is available for property owners that are accredited investors. An accredited investor, as defined by the SEC, is:

Net worth over $1 million, excluding primary residence (individually or with spouse or partner)

Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year.

Investment professionals in good standing holding the general securities representative license (Series 7), the investment adviser representative license (Series 65), or the private securities offerings representative license (Series 82)

-

An UPREIT might be compelling for you if:

You have a very low basis due to repeated 1031s, but are tired of 1031ing or active management

You are thinking about estate planning and want more easily divisible assets without management headaches

You’d like to pass off the stresses of property management to a full time operator

Regulatory stress and compliance is becoming too risky and burdensome for you

An UPREIT might not be compelling for you if:

You need the cash for a next development or other purposes

You have other tax offsets to minimize tax burden, or are not concerned with the tax implications of a standard sale

You want to stay on as property manager or have a 1031 already planned

-

GromaREIT is a private, non-traded REIT. Non-traded assets are often referred to as a “semi-liquid” asset, and liquidity in these assets is more limited than fully liquid assets, such as public stocks. This is a reflection of the less-liquid nature of the underlying real estate assets in the GromaREIT.

GromaREIT shares are generally subject to a one year hold period, and then can be “redeemed”, i.e. sold for cash to the GromaREIT at the current Net Asset Value (NAV) share price. The NAV share price is a reflection of the value of all the assets in the GromaREIT over the shares outstanding. Redemptions are offered quarterly starting in the first year after GromaREIT sets its first NAV, which is expected to occur in 2024.

The GromaREIT has a redemption limit of no more than 5% of the total outstanding shares in the GromaREIT in any given quarter. If redemption requests were to exceed 5% (which as of Q3 2023 has not occurred in any quarter since inception) then redemption requests would be fulfilled proportionally to each request, up to the maximum 5% per quarter.

It is additionally important to note that upon redemption (sale of shares for cash), the holder will be responsible for capital gains, generally from the basis of the asset originally exchanged in the UPREIT transaction. UPREIT transactions facilitate a deferral of capital gains taxes. While a deferral provides real benefits, it is unfortunately not a complete removal of the tax burden. A deferral enables you to leave more of your asset value active and to be in more control of the timing of that tax burden, which itself may serve to minimize the total tax impact. Additionally, holders may be able to engage in potential estate planning techniques to further reduce the overall burden. But the deferral, by itself, does not remove the eventual tax burden, which is generally due upon sale of the shares received during the UPREIT transaction.

To learn more about the Groma UPREIT offering, and the specific rights and restrictions regarding redemption, please read the GromaREIT Private Placement Memorandum at upreit.groma.com/ppm